The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

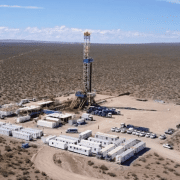

Oil and gas exploration is a cornerstone of the energy industry, with immense potential for investment and revenue. Land access is a crucial aspect of this industry, and two primary avenues are leasing federal lands or private lands for exploration. Each option comes with distinct advantages, drawbacks, legal intricacies, and environmental considerations. In this comprehensive guide, we will explore the differences between leasing federal and private land for oil and gas exploration, the regulatory framework for both, the benefits, potential challenges, and how investors, energy companies, and landowners can navigate this dynamic sector effectively.

Understanding the Importance of Land Leasing in Oil and Gas Exploration

Land access is a fundamental requirement for oil and gas exploration. Land leasing allows energy companies to explore, drill, and extract valuable resources. Two primary types of land leasing exist: federal land leasing and private land leasing.

Leasing Federal Land for Oil and Gas Exploration

Leasing federal land for oil and gas exploration involves obtaining access to lands owned or managed by the federal government, typically through the Bureau of Land Management (BLM). Federal land leasing offers several advantages:

- Broad Access: The federal government owns substantial acreage across the United States, providing ample opportunities for exploration.

- Competitive Bidding: Federal lands are often subject to competitive auctions, potentially leading to favorable terms for lessees.

- Regulatory Framework: The federal government establishes strict regulations and environmental standards to govern exploration on federal lands.

Leasing Private Land for Oil and Gas Exploration

Leasing private land for oil and gas exploration involves negotiating with individual landowners or entities that hold the mineral rights. Private land leasing offers its own set of advantages:

- Flexible Negotiations: Private land leasing allows for more flexible negotiations and agreements tailored to the landowner’s needs.

- Streamlined Process: The process can be quicker and less bureaucratic compared to federal land leasing.

- Potential for Direct Access: Lessees can potentially gain direct access to resource-rich properties without the competitive bidding process.

A Comparative Analysis: Federal vs. Private Land Leasing

To make an informed decision between federal and private land leasing, consider the following aspects:

- Land Availability: Federal land offers more extensive access, while private land availability is determined by landowners’ willingness to lease their mineral rights.

- Lease Terms: Federal leases often come with standardized terms, while private land leases allow for more negotiation.

- Regulatory Oversight: Federal land leases are subject to federal regulations, while private land leases may have less regulatory oversight, depending on state laws.

- Environmental Considerations: Federal lands are typically subject to stricter environmental regulations, making private land leasing potentially less restrictive.

Environmental Considerations: Federal vs. Private Land

Both federal and private land leasing for oil and gas exploration involve environmental considerations:

- Federal Land: Exploration on federal land is subject to rigorous environmental regulations, including assessments and impact studies to minimize environmental damage.

- Private Land: Environmental regulations on private land vary by state and local regulations, potentially offering more flexibility but also more responsibility to lessees.

Legal and Regulatory Framework

The legal and regulatory framework for federal and private land leasing is complex:

- Federal Land: Leasing federal land involves adherence to federal regulations set by agencies like the BLM and the Environmental Protection Agency (EPA).

- Private Land: Leasing private land is influenced by state laws, including regulations concerning property rights, liability, and landowner agreements.

Benefits and Challenges: Federal vs. Private Land

Federal land leasing offers broad access, competitive bidding, and strict regulatory oversight. However, it can involve time-consuming auctions and potentially lengthy permitting processes.

Private land leasing provides more flexibility in negotiations and potentially streamlined processes. It may also come with fewer regulatory burdens, depending on state laws. However, land availability is determined by individual landowners’ willingness to lease their mineral rights.

Lease Acquisition Process: Federal vs. Private Land

The lease acquisition process for federal and private land differs significantly:

- Federal Land: The process often involves competitive bidding at federal lease auctions, rigorous environmental assessments, and regulatory compliance.

- Private Land: Negotiations are conducted directly with landowners, with the process being more streamlined but also requiring effective communication and legal agreements.

Navigating the Decision-Making Process

To make an informed decision about land leasing for oil and gas exploration:

- Assess Your Goals: Clarify your exploration goals, budget, and timeline.

- Engage Professionals: Consult legal experts, landmen, and environmental consultants for informed guidance.

- Market Research: Study current market conditions, commodity prices, and energy trends.

Case Studies

Examine real-world examples of successful federal and private land leasing for oil and gas exploration to gain insights into best practices and potential challenges.

Deciding between federal and private land leasing for oil and gas exploration is a significant decision with diverse implications. By understanding the differences, the regulatory framework, benefits, challenges, and the environmental aspects of each option, landowners, investors, and energy companies can make informed decisions that align with their exploration goals and legal responsibilities. Ultimately, the choice between federal and private land leasing depends on individual circumstances, exploration objectives, and the willingness of landowners to lease their mineral rights.

If you have further questions related to the Federal vs. Private Land topic, feel free to reach out to us here.