The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

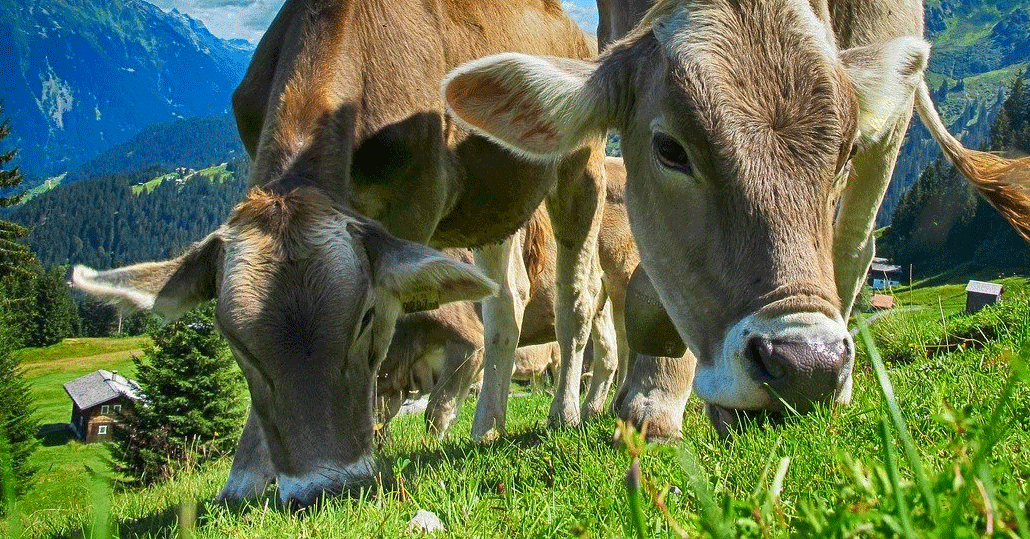

For cowboys and ranchers, owning livestock is as necessary as food, water, and shelter. It is really tiring to herd your livestock until the cows come home. There could come a time to thin or completely rid the entire herd.

No worries if you’ll no longer be reaping the benefits of your animals (i.e. milk, cheese, wool, etc.). The sale of livestock indeed comes with a large cash influx. With this in mind, investors are well aware that capital gains taxes are applicable to high-ticket private asset sales.

Here, a 1031 exchange is useable to essentially “trade” your livestock for a new piece of property. In doing so, the sale is maximizable as capital gains taxes are completely or partially deferrable.

Below, we will detail the steps a taxpayer must take to sell livestock and complete a successful 1031 exchange. With this, we will illustrate why mineral rights are one of the best ways to reinvest your capital with future mineral royalty payments.

How to Sell Your Livestock

Officially, a 1031 exchange begins at the sale of the property asset. Therefore, you must first sell your livestock to initiate the exchange. Many people have the experience in selling occasional “raising to sell” animals to down-market vendors, the overhaul of a large flock can necessitate capital gains taxes to be applicable.

In selling livestock, it is critical that you be honey in describing your herd to the best of your abilities. This includes accurate ages and quantities for all animals as well as any associated legal tags or history.

Determining the Value of Your Livestock

In truth, most livestock is sold at auction. Therefore, the true value of your livestock is only going to be represented by the highest bidder. However, private sales are not unheard of, and livestock is also often bundled into large deals involving farmland or estates. With all of this said, when presenting your livestock to buyers you may need to have an initial bid price, and it is generally good to know the approximate value of your asset before agreeing to proposed terms.

Livestock is valued by the following criteria:

- Types of livestock (cows, bulls, goats, sheep, etc.)

- Quantity

- Age of livestock

- History and projected income streams

- The distance of sale (travel expenses)

- And more

Livestock sales are common to both individuals and businesses. While contracts are only necessary for possible misconceptions in B2B sales, sales to private entities will likely take longer with thorough background checks on livestock conditions and rights of sale.

Taxes Paid on the Selling Livestock

As we mentioned above, large livestock sales often come with heavy taxations. In fact, livestock sales can be expected to retain only 55% to 75%of their total price tag after legal fees and taxes are applied by local and national governments. Depending on your location, the following taxes may be paid on livestock sales:

- Federal Income Taxes

- Capital Gains Taxes

- Sales Taxes

- Local Taxes

- And More

Of course, if your sale is large enough to warrant a capital gains tax, the balance can be deferred by using a 1031 exchange.

Selling Livestock with a 1031 Exchange

With a 1031 exchange, taxpayers can eliminate 100% of capital gains taxes that would be applied if they choose to invest in a new property of equal or greater value. While it is true that you can partially defer the taxes with a lower value asset, many investors use a 1031 exchange as an opportunity to “trade-up” for a higher valued property.

Livestock Like-Kind Properties

Under the IRS code, livestock must be exchanged for “like-kind” property in order for capital gains taxes to be eliminated. Essentially, what this means is that taxpayers must invest in another private property asset. With this in mind, the definition of “like-kind” property is actually quite loose.

Historically, the following can be considered “like-kind” properties of livestock:

- Farms

- Timberland

- Water and Ditch Rights

- Mineral Rights and Royalties

- And more

Livestock 1031 Exchange Timeline

A 1031 exchange officially begins at the time of sale, and taxpayers have officially 180 days to purchase a new like-kind property. During this six-month window, investors must officially identify at least one “reasonable” property within 45 days of the sale of livestock for a 1031 exchange to remain valid.

1031 Exchange Intermediaries for Selling A Livestock

With tight deadlines and detailed paperwork, many busy investors find it necessary to use a 1031 exchange intermediary to successfully eliminate capital gains taxes. While this can open up time for taxpayers to identify new properties, it is also possible to work with an industry specialist that can help identify the best potential property investments in their area of expertise.

Why Purchase Mineral Rights and Royalties?

In the United States, residents have the unique ability to purchase mineral rights of a property, which entitles the owner to everything below the earth’s surface. While this is not available in every country throughout the world, mineral rights have been allowing investors to profit from the natural resources found on and under American soil for over 100 years.

Today, mineral rights owners generally lease their property to an oil and gas company. From there, the company locates, extracts, and sells the resources on the open market. As the mineral rights owner, you will then receive a mineral rights royalty payment as a fixed percentage of the monthly sales.

Conclusion

When the cows don’t me home and you have a large cash sale instead, it is important to consider using a 1031 exchange to maximize the sale. Livestock generally requires extensive maintenance and upkeep. On the other hand, mineral rights is generally a passive way to reinvest capital. This is to have a positive diversification of any investment portfolio.

If you have further questions about 1031 Exchange Livestock, feel free to reach out to us here.