⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

The relationship between natural gas prices and royalty payments is one that plays a critical role in the oil and gas industry. As one of the leading energy sources used across the world, natural gas’s role extends beyond its impact on heating and electricity to how energy production companies compensate landowners and other stakeholders through royalty payments. For both producers and landowners, the fluctuations in natural gas prices can significantly affect the financial landscape. Understanding how natural gas prices influence these payments is essential for all parties involved.

In this article, we will explore the intricate connection between natural gas prices and royalty payments. We will examine how the pricing mechanisms work, the factors that influence gas prices, and the ways these prices can impact the royalties that landowners receive. We will also delve into why certain external forces cause prices to rise and fall, what it means for stakeholders, and the strategic decisions made by companies in response.

Defining Natural Gas Royalties

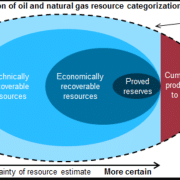

Before diving into the direct relationship between natural gas prices and royalty payments, it’s essential to understand what royalties are. Royalties are a percentage of the revenue from the extraction of natural gas that is paid to the landowner or other parties with a legal claim to the resource. The royalty payments are typically set as a fixed percentage of the sales revenue or production volume, and these payments are made regularly, often quarterly or annually.

These payments are a common practice in the oil and gas industry. Landowners, mineral rights holders, or leaseholders are entitled to a portion of the profits derived from the production of natural gas on their land. This form of compensation incentivizes landowners to lease their land to energy companies in exchange for a consistent source of income, while also providing the companies with the right to explore and extract resources.

While royalty payments are important to landowners, they are typically calculated based on the volume of production and the price at which the natural gas is sold. Therefore, any fluctuation in gas prices directly impacts the payments that landowners receive.

The Mechanics of Royalty Calculations

The royalty payment that a landowner receives is typically based on a contract established between the landowner and the energy producer, often a gas company. This contract stipulates the specific percentage of revenue or production volume that the landowner is entitled to. Commonly, the royalty rate ranges from 10% to 20%, although it can be higher or lower depending on the agreement.

For example, if a landowner has a royalty agreement that entitles them to 15% of the revenue from natural gas extracted from their land, they will receive 15% of the total income generated from the sale of that gas.

The price of natural gas plays a pivotal role in determining the total value of the payment. A higher gas price means more revenue from the sale of gas, resulting in a higher royalty payment. Conversely, when natural gas prices drop, the overall revenue from gas sales decreases, leading to smaller royalty payments for the landowner.

Factors Influencing Natural Gas Prices

Natural gas prices are subject to a variety of factors that fluctuate regularly, often on a global scale. These factors include:

Supply and Demand

The fundamental laws of supply and demand play a significant role in the pricing of natural gas. When supply levels are high, and demand is low, prices typically fall. Conversely, if supply is tight, or demand increases, prices will rise. These changes can occur seasonally, with higher demand in colder months due to heating requirements, for example.

Weather Conditions

Weather plays a particularly crucial role in the natural gas industry. Harsh winters that lead to increased heating demands can spike natural gas prices as consumption rises. Similarly, summer heatwaves can increase the demand for electricity, much of which is powered by natural gas, driving prices up.

Economic Growth

Economic growth or recession also impacts natural gas prices. A booming economy can lead to increased industrial demand, which in turn raises the need for natural gas as a source of energy. On the other hand, during economic downturns, decreased industrial activity can lead to reduced demand and, therefore, lower prices.

Production Levels

The amount of natural gas that is produced, stored, and transported also affects market prices. Changes in production levels, whether due to technological advancements, regulations, or disruptions in supply, can alter gas prices significantly. High production levels may depress prices, while supply interruptions, like those caused by natural disasters or geopolitical factors, may lead to a price surge.

Geopolitical Events

Political instability, conflicts, and other geopolitical factors can disrupt the supply of natural gas or cause shifts in trade agreements. These disruptions can result in sudden price changes on the global market, affecting prices domestically and internationally.

Regulatory Factors

Government policies, including environmental regulations, taxes, and subsidies, can directly impact natural gas production and prices. A country’s regulatory stance on energy production or consumption, particularly concerning fossil fuels like natural gas, can either promote or constrain production and influence price trends.

Technological Innovations

Advancements in extraction and production technologies, such as hydraulic fracturing (fracking) and horizontal drilling, have revolutionized the natural gas industry. These innovations have made it possible to access previously untapped reserves, contributing to an increase in supply and potentially lowering prices.

Global Energy Markets

Since natural gas is a globally traded commodity, prices are often influenced by market dynamics in other parts of the world. Events such as shifts in global supply chains, international trade agreements, and energy export restrictions can cause volatility in natural gas prices.

How Natural Gas Prices Directly Impact Royalties

The direct connection between natural gas prices and royalty payments becomes apparent. This is when we consider the mechanics of royalty payment calculations. As previously mentioned, these payments are usually tied to a fixed percentage of the revenue. More often tied to the volume of natural gas produced. The price of natural gas directly impacts the revenue generated. With that, any fluctuation in price has an immediate effect on the amount of money landowners receive.

When natural gas prices are high, the revenue from the sale of natural gas increases. This leads to higher royalty payments, providing a boost to the income of landowners or leaseholders. This is particularly beneficial during periods of high demand, such as extreme weather events that create a spike in consumption. For landowners, higher gas prices mean more substantial royalty checks.

On the other hand, when prices fall, the opposite happens. Reduced revenue from the sale of natural gas leads to lower royalty payments. This can have significant financial implications for landowners. Especially if they are dependent on these payments for a significant portion of their income. The unpredictability of gas prices can make it challenging for landowners to plan for their financial future. This is as the amount of royalty payments they receive is not fixed.

In cases of prolonged price downturns, energy companies may also reduce production in less profitable regions, which could further reduce the amount of natural gas being extracted and sold. This results in fewer royalty payments for landowners, further exacerbating the financial uncertainty they may face.

How Natural Gas Prices Affect Strategic Responses from Energy Companies

Energy companies are not immune to the effects of fluctuating gas prices. As prices rise and fall, these companies must make strategic decisions on how to manage their operations. During periods of low natural gas prices, companies may reduce their exploration and drilling activities in order to minimize costs. This can reduce the overall volume of natural gas being extracted, leading to a corresponding decline in royalty payments for landowners.

Conversely, when gas prices are high, energy companies may ramp up their production to take advantage of the favorable market conditions. This could lead to more extraction activities and a larger volume of natural gas sold, benefiting both the companies and landowners through increased royalty payments.

For energy companies, these fluctuations also affect their profitability and long-term planning. In response to volatile prices, companies may employ hedging strategies to mitigate financial risks, locking in prices for future production in advance. These strategies help smooth out the impacts of price volatility, ensuring that companies and landowners receive more predictable compensation regardless of short-term price movements.

Managing Price Fluctuations: A Case for Diversification

While natural gas price fluctuations are inevitable, one way for landowners to protect themselves is by diversifying their portfolios. This may involve leasing out multiple plots of land to different companies, engaging in multiple types of energy production, or seeking compensation based on alternative formulas.

Landowners can also explore different royalty structures, such as a fixed price agreement, which can offer a level of predictability for royalty payments, regardless of market price changes. Fixed price agreements are beneficial during times of extreme price volatility, providing landowners with stability even when prices fall.

The connection between natural gas prices and royalty payments is intricate and multifaceted. Landowners and energy companies must both navigate the challenges of fluctuating prices, which can create significant financial consequences for both sides. As natural gas prices rise, royalty payments increase, providing substantial benefits for landowners. However, when prices fall, the opposite occurs, leading to financial difficulties for those reliant on these payments.

Both landowners and energy producers must understand the various factors that influence natural gas prices and explore strategies to mitigate risk and uncertainty. While prices will always be subject to market forces, thoughtful decision-making, diversification, and long-term planning can help landowners and companies make the most of their energy assets in an unpredictable landscape.

Do you have further questions related to How Natural Gas Prices increase? Reach out to us here.