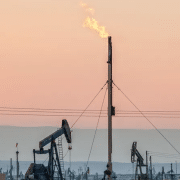

Exxon Mobil Corp. has surpassed analysts’ expectations for the third quarter, driven by a notable increase in oil production from the U.S. Permian Basin, which effectively mitigated the impact of declining crude prices and tighter refining margins. The company reported earnings of $1.92 per share, exceeding the median analyst estimate of $1.87 as compiled by Bloomberg. This performance aligns with a broader trend among major oil companies, as both Chevron Corp. and Shell Plc also delivered results that exceeded market predictions, highlighting a resilient sector amid fluctuating commodity prices.

In a year marked by volatility in the global oil market, Exxon has emerged as the leading performer among major oil producers, with its stock rising over 15% despite a general downturn in international crude prices. This remarkable achievement underscores Exxon’s strategic focus on enhancing oil and natural gas production while reducing operational costs.

Exxon The Largest Energy Explorer

As North America’s largest energy explorer, the company has showcased an impressive capacity for not only expanding its production capabilities but also optimizing operational efficiencies that outpace those of its competitors. This strategic advantage is further underscored by a commitment to leveraging cutting-edge technologies and innovative practices that enhance resource extraction and management. By investing in advanced exploration techniques, the company has been able to identify and tap into previously untapped reserves, thereby significantly increasing its output. This proactive approach not only strengthens its market position but also ensures a sustainable and reliable supply of energy, which is crucial in meeting the growing demands of an ever-evolving energy landscape.

Moreover, the company’s ability to navigate the complexities of the current energy environment—characterized by fluctuating prices, regulatory challenges, and an increasing shift toward renewable energy sources—demonstrates its resilience and adaptability. In aligning its growth strategies with environmental sustainability goals, the company is also positioning itself as a forward-thinking leader in the industry.

By prioritizing investments in renewable energy initiatives and carbon reduction technologies, it not only meets regulatory requirements but also addresses the growing consumer demand for cleaner energy alternatives. This dual focus on traditional energy production and sustainable practices not only enhances the company’s reputation but also secures its future as a key player in the transitional energy economy.

Click here to read the full article

Source: Energy Connects

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.