EIA: Permian oil output to surge 8% in 2024

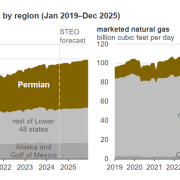

Once again, the Permian Basin is expected to lead growth in the nation’s overall oil production as per EIA.

The Energy Information Administration forecasts that crude production from the Permian Basin will average about 6.3 million barrels per day this year. This is an increase of 8% over 2023 and accounting for nearly half of all crude production.

Permian production will contribute about two thirds of all US oil production through the end of 2025. This is according to the EIA’s June Short-Term Energy Outlook. The EIA expects increased production from the Permian. It also affect regions since it will drive US production to record highs in both 2024 and 2025.

“The Permian region’s proximity to crude oil refine and export terminals on the Gulf Coast. It established takeaway capacity and improved new well productivity to support crude oil production growth in the region,” the EIA wrote in its June 2024 Short-Term Energy Outlook.

“Without a doubt, the mighty Permian Basin is the major factor. It makes Texas the 8th largest economy in the world”. This is what Todd Staples, president of the Texas Oil & Gas Association, commented to the Reporter-Telegram by email.

“The Permian Basin leads US energy production. It single-handedly contributing nearly 45% of domestic oil production, thanks to its phenomenal reserves, private sector investment in infrastructure, and Texas’ welcoming business climate that includes a stable regulatory environment,” he continued.

Click here to read the full article

Source: mrt

—

If you have any questions or thoughts about the topic related to EIA, feel free to contact us here or leave a comment below.

Leave a Reply

Want to join the discussion?Feel free to contribute!