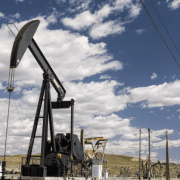

According to the U.S. Energy Information Administration (EIA), crude oil production in the Permian Basin, which spans western Texas and southeastern New Mexico, is expected to rise by nearly 8% this year. The basin accounts for nearly half of U.S. crude oil production.

On Tuesday (June 11), the EIA released the June Short-Term Energy Outlook that shows crude oil production in the Permian Basin will average about 6.3 million barrels per day in 2024, up almost 8% from 2023. The increased production in this and other regions will contribute to successive crude oil production records in the United States in 2024 and 2025.

The Energy Information Administration (EIA) has recently introduced an enhancement to its Short-Term Energy Outlook reports by incorporating detailed regional forecasts for the primary oil and natural gas production areas in the United States. This development reflects the agency’s commitment to providing a comprehensive and granular analysis of energy trends across the country. By specifically focusing on key regions such as Appalachia, Bakken, Eagle Ford, Haynesville, and Permian, the EIA aims to offer stakeholders, policymakers, and industry experts a more nuanced understanding of the dynamics shaping the energy landscape at a local level.

Inclusion of Regional Forecasts

The inclusion of these regional forecasts not only enables a more detailed assessment of production trends. Moreovre, it also facilitates a deeper exploration of factors influencing supply and demand dynamics in specific geographic areas. This new approach underscores the EIA’s dedication to delivering insights that support informed decision-making. The strategic planning within the energy sector is also seen. This sheds light on regional variations in oil and gas production. Also, the EIA’s expanded Short-Term Energy Outlook reports serve as a valuable resource for industry professionals. More are now seeking to navigate the complexities of the US energy market with greater precision and foresight.

Click here to read the full article

Source: TB&P

—

Do you have any questions or thoughts about the topic EIA: Permian Basin? Feel free to contact us here or leave a comment below.