⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

The COVID-19 pandemic has brought unprecedented challenges to various industries, including the mineral rights sector. As the world gradually emerges from the crisis, it’s essential to analyze the implications for mineral rights holders and stakeholders. This comprehensive examination delves into the future of mineral rights post-pandemic, exploring shifts in demand, regulatory changes, and strategies for adaptation.

The pandemic’s impact on the mineral rights industry has been multifaceted, influencing global demand, market dynamics, and regulatory frameworks. Understanding these changes is crucial for navigating the post-pandemic landscape effectively.

Market Trends

One of the key factors shaping the future of mineral rights is evolving market trends. The pandemic disrupted supply chains, leading to fluctuations in demand for various minerals. While some sectors experienced downturns, others, such as renewable energy and technology, witnessed increased demand. Analyzing these trends can help mineral rights holders identify emerging opportunities and adjust their strategies accordingly.

Technological Advancements

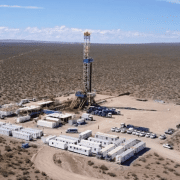

Advancements in technology continue to reshape the mineral rights landscape, with innovations in extraction techniques, data analytics, and environmental monitoring. Post-pandemic, there is likely to be a greater emphasis on sustainable practices and efficient resource utilization. Mineral rights holders must stay abreast of these developments to remain competitive in the evolving industry.

Environmental Considerations

The pandemic highlighted the interconnectedness of human health, environmental sustainability, and resource extraction. As governments and organizations prioritize environmental conservation and climate action, mineral rights holders face heightened scrutiny and regulatory pressure. Adapting to these changing norms requires proactive measures, such as adopting eco-friendly practices and engaging in stakeholder dialogue.

Regulatory Outlook

Post-pandemic regulatory changes are inevitable as governments reassess their policies in light of evolving priorities and challenges. From permitting processes to taxation policies, mineral rights holders must anticipate regulatory shifts and ensure compliance to mitigate risks and maintain operational continuity.

Community Engagement

Community relations have become increasingly important for mineral rights holders, particularly in the wake of the pandemic. Engaging with local communities, addressing concerns, and fostering mutually beneficial partnerships can enhance social license to operate and mitigate conflicts. Post-pandemic, proactive community engagement will be integral to the sustainable development of mineral resources.

Investment Strategies

Navigating the post-pandemic mineral rights landscape requires strategic investment decisions informed by market insights, regulatory analysis, and risk assessment. From diversifying portfolios to exploring emerging markets, mineral rights holders must adopt a forward-thinking approach to maximize returns and mitigate volatility.

The future of mineral rights post-pandemic is marked by uncertainty, yet brimming with opportunities for those willing to adapt and innovate. By staying abreast of market trends, embracing technological advancements, prioritizing environmental sustainability, and fostering positive community relations, mineral rights holders can navigate the evolving landscape with confidence and resilience. As the world rebuilds and recovers, the mineral rights sector remains a cornerstone of economic growth and development, poised to play a pivotal role in shaping the future of resource extraction.

If you have questions related to the future of mineral rights, feel free to contact us here.

Remember: This information is for educational purposes only. Consult qualified professionals for advice specific to your situation and jurisdiction.