BP, the oil company that once aimed to lead the shift to renewable energy, is now on board with President Trump’s mantra of “drill, baby, drill,” The Wall Street Journal writes. Learn more about BP plans in this post.

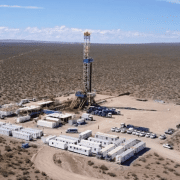

The London-based energy company announced Tuesday it was aiming to boost its U.S. production of oil and gas by more than 50% by the end of the decade. The announcement to boost production comes as BP has cut its green spending while repivoting toward fossil fuel investments.

In February, the company said it would boost oil and gas production and cut investments in clean energy. On Tuesday, BP announced that a senior executive in charge of green energy investments would leave the company and would not be replaced.

“We’re pretty tightly aligned with the president,” Chief Executive Murray Auchincloss said in an interview, adding that the company plans to raise U.S. production from 650,000 barrels a day to more than 1 million by 2030.

“It’s both in oil and gas onshore and oil and gas in the Gulf of America,” he says, using Trump’s preferred name for the Gulf.

Click here to read the full article

Source: Business Report

—

Do you have any questions or thoughts about the topic BP plans? Feel free to contact us here or leave a comment below.