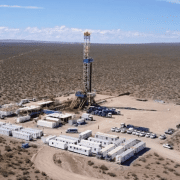

With the arbitration proceedings that followed in the wake of Chevron’s $53 billion all-stock deal to acquire Hess Corporation, now out of the way, the U.S. player is the new partner in Guyana’s Stabroek block, where ExxonMobil and CNOOC are its partners. The Hess acquisition is Chevron’s third upstream deal since 2020, following Noble Energy in 2020, REG in 2022, and PDC Energy in 2023.

Previously, ExxonMobil and CNOOC initiated the arbitration process, as they believed they should have a right to a first refusal over any sale of Hess’ 30% interest in Guyana’s oil-rich offshore block under the existing joint operating agreement. This delayed the Chevron-Hess merger, originally announced in 2023, dragging the business combination closure date into 2025.

Despite obstacles in its path, the U.S. duo still managed to progress the merger by securing Hess stockholder approval and clearing the Federal Trade Commission (FTC) antitrust review, convinced that preemptive rights in the Stabroek block joint operating agreement do not apply.

Following the arbitration win, Chevron highlighted: “With the merger complete, Chevron and Hess are moving forward with integrated operations—and looking forward to a quick, efficient transition. When two companies come together, the result should be more than just bigger—it should be better, too.

Click here to read the full article

Source: Offshore Energy

Do you have any questions or thoughts about the topic related to Chevron-Hess merger? Feel free to contact us here or leave a comment below.