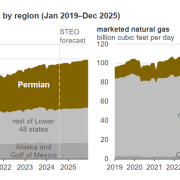

The U.S. oil output hit an all-time high in the final two months of 2023. It is with year-over-year growth clocking in at over 1 million barrels per day. This is what the Energy Information Administration (EIA) said on Monday. Basically, the American shale output from the top-producing regions would soar to a six-month high in June.

This was during the monthly Drilling Productivity Report released on Monday. the EIA said production in the top basins in the American shale. Its patch would hit 9.85 million barrels per day–a volume not seen since December.

Shale output accounting for some 75% of total U.S. oil production and well productivity. It improved by the day, output has a clear path for increasing.

According to the EIA, the production per new drilling rig in the Permian basin should hit 1,400 bpd in June, compared to 1,386 in May, which also represents the highest monthly output per single rig since late 2021. Overall, output in the Permian Basin is expected to rise to 6.19 million bpd for a total rise of nearly 18,000 bpd. By comparison, Eagle Ford output in Texas is poised to reach 1.11 million bpd–a record since last December, while output in the Bakken will increase just barely.

In December last year, U.S. crude oil production rose from 11 million bpd in July to 13.3 million bpd. This is as producers took advantage of higher oil prices coming off a pandemic.

Click here to read the full article

Source: Oil & Gas 360

—

Do yyou have any questions or thoughts about the topic related to American Shale Output? Feel free to contact us here or leave a comment below.