Mega Acquisition Deals

ExxonMobil and Chevron announced mega acquisition deals to buy U.S. firms, which will boost the footprint of the U.S. oil supermajors in their domestic upstream market. Betting on expectations of sustained global oil and gas demand and the lower costs of supply through synergies with the targeted acquired companies.

Exxon and Chevron are now looking to build stronger portfolios closer to home after divesting assets in Western Europe, West Africa, and Russia. Amid growing geopolitical uncertainties and flare-ups in other parts of the world, the U.S. supermajors are betting on higher domestic production and the huge reserves of Guyana

Basically in America’s backyard in Latin America—to strengthen their portfolios with more advantaged resources and raise returns to investors.

The End of an Era

The U.S. oil giants holding a variety of assets spread worldwide is over, analysts have told The Wall Street Journal.

This month, Exxon announced a deal to buy Pioneer Natural Resources in an all-stock transaction valued at $59.5 billion. The implied total enterprise value of the transaction, including net debt, is around $64.5 billion.

Two weeks later, Chevron said it would buy Hess Corporation in an all-stock transaction valued at $53 billion with a total enterprise value, including debt.

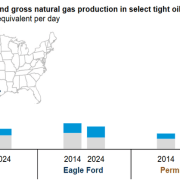

The deals, Exxon, which has pulled out of Russia, Cameroon, and Chad in recent years, will become the Permian’s top producer. Chevron, for its part, will add assets offshore Guyana and in the U.S. Bakken shale play, after ditching assets in the UK and Norway in recent years.

Chevron will Become Exxon’s Partner

By buying Hess, Chevron will become Exxon’s partner in Guyana’s vast discovered resources under development. Chevron will get 30% ownership in more than 11 billion barrels of oil equivalent discovered recoverable resource with high cash margins per barrel, strong production growth outlook, and potential exploration upside, the company said.

Guyana is more politically stable than other parts of the world and closer to the United States—efficient for crude exports to America.

Being Disrupted By Geopolitical Turmoil

In a sign of operations being disrupted by geopolitical turmoil, weeks before the announced acquisition of Hess, Chevron was ordered by Israel to shut down production at the offshore Tamar gas field following the Hamas attack.

The Hess deal will also give Chevron 465,000 net acres of high-quality, long-duration inventory in the Bakken supported by the integrated assets of Hess Midstream, complementary U.S. Gulf of Mexico assets, and steady free cash flow from its Southeast Asia natural gas business.

In the Bakken, Hess Corp’s net production was 190,000 barrels of oil equivalent per day (boepd) in the third quarter of 2023, compared with 166,000 boepd in the prior-year quarter, reflecting increased drilling and completion activity and higher NGL and natural gas volumes received under the percentage of proceeds contracts due to lower commodity prices.

In the Permian, Exxon will become the biggest producer after the Pioneer deal.

Upstream Portfolio

The combination with Pioneer “transforms ExxonMobil’s upstream portfolio by increasing lower-cost-of-supply production, as well as short-cycle capital flexibility,” Exxon said when announcing the deal.

The company expects a cost of supply of less than $35 per barrel from Pioneer’s assets.

“By 2027, short-cycle barrels will comprise more than 40% of the total upstream volumes, positioning the company to more quickly respond to demand changes and increase capture of price and volume upside.”

Click here to read the full article

Source: Oil Price

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.