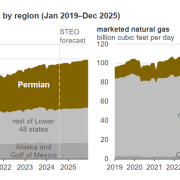

What happens when the world’s largest oil producer goes all-out to boost production just as the appetite of the world’s largest oil importer may be peaking? Demand of Chinese oil— which has accounted for half of all world oil demand growth over three decades — shows signs of levelling off thanks to slowing economic expansion and an epochal shift to green power and electric vehicles. Returning US President Donald Trump has, meanwhile, declared a national energy emergency intended to boost fossil fuel output, and begun to reverse the Biden administration’s green agenda. In theory, these dynamics might lead to an oil glut and falling prices. The reality is more complex.

The US-China divergence is at root about competing visions of energy security. Beijing’s embrace of renewable energy reflects less a noble conversion to saving the planet, and more a strategic determination to reduce dependence on imported oil. Conversely, alongside the popularity of his “drill, baby, drill” mantra among consumers balking at the costs of the green transition, Trump does not want the US to rely on a green energy supply chain dominated by China.

Click here to read the full article

Source: Financial Times

—

If you have any questions or thoughts about the topic Chinese Oil, feel free to contact us here or leave a comment below.