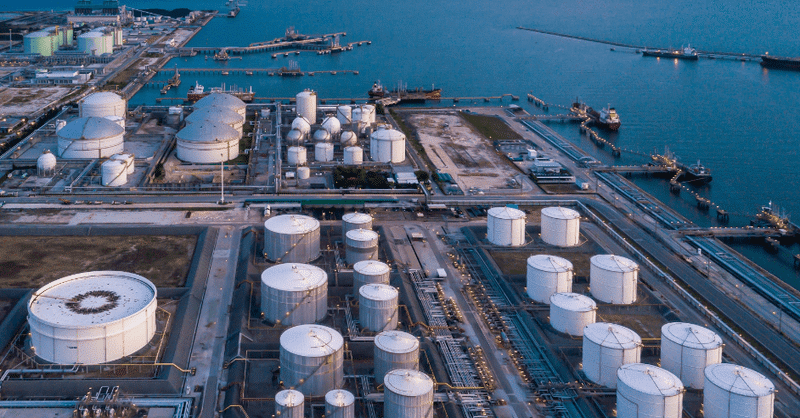

U.S. Energy Development Corporation (USEDC), a Fort Worth-based exploration and production company focused on developing oil and gas projects. It is for itself and its partners. It has acquired ~20,000 net acres in Reeves and Ward Counties, Texas. The position includes a substantial proved producing component and multi-year drilling inventory to supplement the firm’s existing footprint in the area. This landmark transaction marks the largest single acquisition in the company’s 45-year history and significantly expands its total Permian Basin holdings. Let’s learn more about how USEDC expands Permian footprint.

Dedicated Drilling Rig

“This transaction greatly enhances the overall quality and resilience of our portfolio, supplementing our reserves with additional proved producing assets, adding years of multi-bench drilling inventory, and expanding our operated economies of scale,” said Jordan Jayson, CEO and chairman of USEDC. “These factors position USEDC for sustained, efficient growth and reinforce our commitment to delivering long-term value for our partners.”

USEDC plans to run a dedicated drilling rig on the acquired acreage. It is making this acquisition a key component of USEDC’s 2025 plan to invest up to $1 billion in U.S. oil and gas properties. In 2024, the firm deployed about $850 million in operated and non-operated oil and gas projects in the basin. The firm’s team continues to evaluate opportunities that align with its disciplined investment strategy and can deliver value to our partners.

RBC Richardson Barr advised on the process and Willkie Farr & Gallagher LLP advised USEDC on the acquisition.

Increased Citibank, N.A. Credit Facility</strong>

Concurrent with this acquisition, USEDC completed an increase in the borrowing base and commitments. This is under its syndicated revolving credit facility led by Citibank, N.A. It is from $165 million to $300 million. The upsized revolving credit facility provides USEDC with significant financial flexibility to support its continued growth and has a maximum credit amount of $500 million.

Click here to read the full article

Source: Oil & Gas 360

—

Do you have any questions or thoughts about USEDC expands Permian footprint? Feel free to contact us here or leave a comment below.