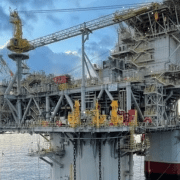

The Trump administration said on Thursday that it will no longer require environmental impact statements. This is for oil and gas leases across the U.S Green Analyses West. It is a step toward lifting green hurdles to drilling that environmental groups will likely challenge in court.

The Interior Department said in a release that it will no longer require its Bureau of Land Management to prepare environmental impact statements. This is for about 3,244 oil and gas leases across Colorado, Montana, New Mexico, North Dakota, South Dakota, Utah, and Wyoming.

Environmental impact statements are analyses of the impacts of federal actions. It will have a significant effect on the environment. They are for major projects under the bedrock 1970 U.S. environmental law, the National Environmental Policy Act.

U.S. President Donald Trump has long sought to fight NEPA’s requirements. On January 20, his first day back in office, he signed an executive order aiming to speed up energy permitting by requiring the head of the White House’s Council on Environmental Quality to propose doing away with its NEPA requirements, including consideration of greenhouse gas emissions of major projects.

Interior said that the BLM is evaluating options for compliance with NEPA for the oil and gas leasing decisions.

Click here to read the full article

Source: Oil & Gas 360

—

Do you have any questions or thoughts about the topic U.S Green Analyses? Feel free to contact us here or leave a comment below.