U.S drillers and energy firms this week added oil and natural gas rigs for a second week in a row for the first time since July 2024, energy services firm Baker Hughes said in its closely followed report on Friday.

The oil and gas rig count, an early indicator of future output, rose by four to 586 in the week to February 7.

Despite this week’s rig increase, Baker Hughes said the total count was still down 37 rigs, or 6% below this time last year.

Baker Hughes said oil rigs rose by one to 480 this week, while gas rigs increased by two to 100.

Growth in oil output from the U.S. Permian basin, the country’s top oilfield, is expected to slow by at least 25% this year despite President Donald Trump’s vow to maximize production, energy executives forecast on Thursday.

While the U.S. is already the world’s top oil producer with output of about 13.2 million barrels per day (bpd) in 2024, total U.S. production growth has slowed in recent years, climbing only about 280,000 bpd last year.

<p class=”yf-1pe5jgt”>The oil and gas rig count declined by about 5% in 2024 and 20% in 2023 as lower U.S. oil and gas prices over the past couple of years prompted energy firms to focus more on paying down debt and boosting shareholder returns while increasing drilling efficiencies to raise output.

Click here to read the full article

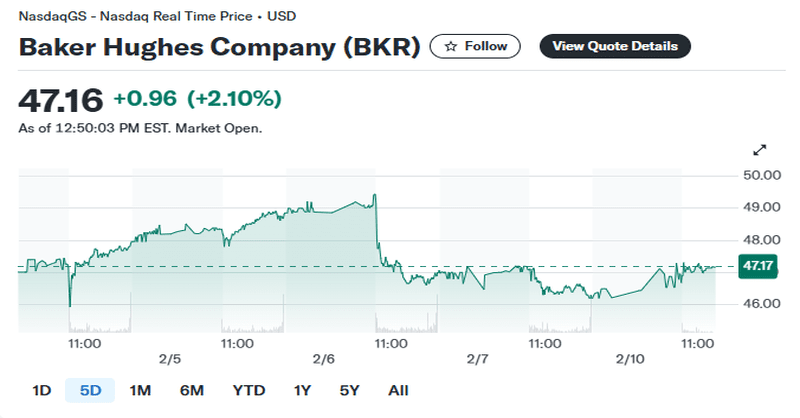

Source: yahoo!finance

–&lt;/p>

If you have any questions or thoughts about U.s drillers, feel free to contact us here or leave a comme

nt below.