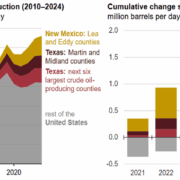

Back in 2017, oil production in the Permian stood at 2.2 million barrels daily. Today, the Permian is producing over 6 million barrels daily, accounting for nearly half of the U.S. total. Predictions of a looming peak have lately multiplied. According to Wood Mackenzie, the Permian is not done yet—not if prices improve.

To be sure, the boom days seem to be over. Production growth in the most prolific shale play in the United States. It has been slowing already as production costs climb higher while oil prices slide lower. Most forecasts for the region agree that growth in production. It is about to slow down further, and Wood Mac is no exception. The consultancy expects output there to add 200,000 barrels daily this year, for a total of 6.6 million barrels daily.

Going forward, growth is about to continue slowing, and the analysts predicted. Until production peaks at 7.7 million barrels daily in 2035. Yet, while many assume that a peak is inevitably followed by a decline, this will not be the case in the Permian. Output of crude oil in the play will plateau at 7.7 million bpd, and this will more than offset production declines in other producing regions in the country—meaning oil demand will be healthy enough to support such a trend.

Companies with big footprints in the Permian, therefore, can enjoy said footprint even with slower growth. Yet companies tend to seek new growth opportunities all the time to sustain their business, and the prospect of peak growth in the Permian is a real one. The gas-to-oil ratio of output there has been on the rise, as has the water-to-oil ratio in the play. Both trends suggest that some formations in the basin are reaching geological constraints, and more drilling isn’t necessarily proportionate to the oil volumes produced.

Indeed, Big Oil executives have predicted that peak oil supply will arrive in the U.S. before 2035. This does not, of course, mean they are right and Wood Mac analysts are wrong. It simply means that nothing is certain until it happens. And it seems that the slowdown in the Permian is already happening. It also seems that the challenges are multiplying: the latest is concern that toxic wastewater in underground reservoirs could leak and that it could affect seismic activity in the area. In response to these risks, the Railroad Commission of Texas has started imposing restrictions on the amount of wastewater disposed of underground until pressure levels subside.

Click here to read the full article

Source: Oil & Gas 360

—

Do you have any questions or thoughts about the topic The Permian? Feel free to contact us here or leave a comment below.