⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, no guarantee is made to that effect, and laws may have changed since publication.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

Fracking, or hydraulic fracturing, is one of the most controversial and transformative technologies in modern oil and gas extraction. Over the past few decades, it has revolutionized the way energy companies extract oil and natural gas from previously inaccessible reserves. The growth of fracking has reshaped the energy landscape, significantly increasing the production of oil and gas in regions that were once considered off-limits. But what does this technological revolution mean for royalty owners, who traditionally benefit from the extraction of resources beneath their land?

Royalty owners, including private landowners, businesses, and government entities, often rely on payments from energy companies as compensation for the extraction of natural resources. These payments are typically a percentage of the revenue generated from the sale of oil or gas, and they form an essential part of the income for many landowners and investors. As fracking continues to evolve, it brings both opportunities and challenges for royalty owners. In this article, we will explore the economics of fracking and analyze its implications for those who rely on royalties from oil and gas production.

Understanding the Process of Fracking

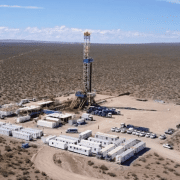

Before delving into the economic impact of fracking on royalty owners, it’s important to understand how the process works. Engineers inject high-pressure fluid into deep underground rock formations during hydraulic fracturing to break apart the rock and release oil or natural gas trapped within. The process typically includes a mixture of water, sand, and chemicals that workers pump into the well at high pressure to create fractures in the rock. Once the fractures are created, oil and gas can flow more easily to the surface.

Companies often combine fracking with horizontal drilling, which allows them to create longer wells that can access a larger area of the rock formation. This combination of techniques has enabled energy companies to access previously uneconomic oil and gas reserves, often in shale formations that are widespread across the United States and other parts of the world.

For royalty owners, the economic implications of fracking arise from how it impacts the overall production levels of oil and gas.

The Impact of Fracking on Oil and Gas Production

One of the most significant ways in which fracking has altered the oil and gas market is by dramatically increasing production levels. In regions such as the Permian Basin in West Texas, the Bakken Shale in North Dakota, and the Marcellus Shale in Pennsylvania, fracking has unlocked vast quantities of oil and gas, leading to a boom in production. In the United States, the rise of fracking has made the country one of the world’s leading oil and gas producers, drastically reducing its reliance on imported energy.

For royalty owners, this surge in production can translate into higher royalty payments. With more oil and gas being produced from previously untapped reserves, royalty owners stand to benefit from a greater volume of resource extraction. The more oil or gas that is extracted from the land, the more revenue is generated, and therefore, the higher the potential royalty payments.

However, it’s important to note that while the increase in production is a positive development for royalty owners in the short term, the long-term effects may not be as straightforward. Fracking can lead to rapid depletion of wells, meaning that while production may be high in the early years, it can taper off quickly once the reserves are exhausted. This creates a situation where royalty owners may receive substantial payments initially, but the revenue stream could decline over time.

The Economics of Declining Well Productivity – Economics of Fracking

One of the defining characteristics of fracking operations is the rapid decline in well productivity. Unlike traditional vertical wells, which often produce oil and gas at a relatively steady rate over many years, fracked wells experience a sharp decline in output soon after the initial production phase. This phenomenon is often referred to as “decline curve” behavior, and it can have significant implications for royalty owners.

In the first few months or years of a fracked well’s operation, production rates are typically very high. This can lead to lucrative royalty payments for landowners. However, as the well depletes its reserves, production decreases at an accelerating rate. This decline in production means that the royalty payments, which were initially high, can diminish significantly over time.

For royalty owners, this creates a situation where they may receive a large sum early in the life of the well but face a sharp drop in income as the well’s output declines. This dynamic can be particularly challenging for landowners who rely on consistent royalty income over the long term. While the early payouts can be substantial, they may not be sustainable in the long run unless new wells are drilled or existing wells are enhanced through techniques such as re-fracking.

The Financial Structure of Royalty Payments

The landowner and the energy company typically agree on a percentage of the revenue generated from the sale of oil and gas in the lease agreement, which structures the royalty payments.

This percentage is agreed upon in the lease agreement between the landowner and the energy company. However, the financial structure of royalty payments can vary based on several factors, such as the price of oil and gas, the volume of production, and the costs incurred by the energy company in the extraction process.

In the case of fracking, the economics of royalty payments can be more complex. The costs associated with fracking are often higher than those for traditional drilling methods. Fracking requires substantial investment in drilling equipment, hydraulic fracturing fluid, and environmental mitigation measures, which can reduce the amount of revenue available for royalty owners. Energy companies may also be able to deduct certain costs associated with fracking from the gross revenue before calculating the royalty payments.

For royalty owners, understanding the full financial picture is crucial. While they may benefit from the high production levels associated with fracking, they must also consider the potential for reduced payments due to the higher operational costs and the rapid depletion of wells.

In some cases, royalty owners may negotiate terms in their lease agreements to account for the higher costs of fracking, ensuring that they calculate their royalty percentage based on the net revenue rather than gross revenue.

The Role of Commodity Prices in Royalty Payments – Economics of Fracking

The price of oil and natural gas is one of the most important factors affecting the economics of fracking for royalty owners. Fracking has made previously uneconomic reserves accessible, but the profitability of these wells remains closely tied to global commodity prices. When oil and gas prices are high, companies generate greater revenue from extraction, which leads to higher royalty payments for landowners.

However, when commodity prices decline, as seen during periods of global economic downturns or oversupply in the market, royalty payments can drop significantly. Even if production remains high, lower commodity prices can reduce the revenue generated from the sale of oil and gas, thereby reducing the royalty income for owners.

This price volatility creates a degree of uncertainty for royalty owners, as they must contend with fluctuations in the energy markets that can dramatically affect their income. While the short-term benefits of fracking may seem attractive during periods of high commodity prices, the long-term viability of royalties depends on the stability and sustainability of energy prices.

Environmental and Regulatory Considerations

The environmental impact of fracking has been a topic of significant debate and concern. While proponents argue that fracking is a safer and cleaner alternative to coal and other fossil fuels, critics point to the potential for groundwater contamination, air pollution, and seismic activity associated with the process. As a result, fracking operations are increasingly subject to regulatory oversight, which can affect the economics of production and the potential for royalty payments.

For royalty owners, the introduction of stricter regulations or environmental restrictions can increase the operational costs of energy companies. In some cases, these regulations may even prevent new fracking operations from taking place, limiting the number of wells drilled and reducing the overall production levels. This can have a direct impact on royalty owners, as fewer wells and lower production levels mean reduced royalty payments.

Additionally, public concern over environmental issues may lead to increased pressure on governments to impose additional taxes or fees on oil and gas extraction, which could further reduce the profitability of fracking operations. Royalty owners will need to keep a close eye on the regulatory landscape to understand how potential changes in environmental laws and regulations may affect their royalty income.

The Future of Fracking and its Implications for Royalty Owners – Economics of Fracking

As the world transitions toward renewable energy sources and grapples with the challenges of climate change, the future of fracking is uncertain. While fracking has enabled a significant increase in oil and gas production, there is growing pressure from environmental activists and policymakers to reduce dependence on fossil fuels.

For royalty owners, this evolving energy landscape presents both challenges and opportunities. On the one hand, declining demand for oil and gas could reduce the profitability of fracking operations and lead to lower royalty payments. On the other hand, advancements in technology and the development of cleaner fracking techniques could help mitigate some of the environmental concerns associated with the process, potentially extending the life of existing wells and increasing long-term production.

Ultimately, the future of royalty payments will depend on the balance between production levels, commodity prices, and regulatory changes. As fracking technology continues to evolve and the energy market shifts toward a more sustainable future, royalty owners will need to remain adaptable and stay informed about developments in the energy sector.

The economics of fracking has transformed the landscape of oil and gas extraction, creating both opportunities and challenges for royalty owners. While fracking has led to a significant increase in production and higher royalty payments in the short term, the rapid depletion of wells and volatility in commodity prices can result in long-term uncertainty. Royalty owners must navigate this complex and evolving landscape by understanding the factors that affect their income, including production rates, commodity prices, regulatory changes, and environmental considerations. By staying informed and adapting to the changing energy market, royalty owners can maximize the financial benefits of fracking while managing the inherent risks.

Do you have any questions related to Economics of Fracking? Reach out to us here.