Oil prices are sagging like a tired trampoline, and U.S. shale producers are feeling the bounce—just not in a good way. With WTI dancing around $60 and analysts wringing their hands over breakeven levels near $65, you’d be forgiven for assuming the shale patch was in full panic mode.

But U.S. Energy Secretary Chris Wright—former CEO of Liberty Energy and now the government’s top oil whisperer—seems utterly unbothered.

“The U.S. shale industry is going to survive and thrive,” Wright declared this week in Abu Dhabi, where optimism apparently flows as freely as the crude. “In 2015 and 2016 oil prices twice hit $28 [per barrel], and what happened? What did the U.S. shale industry do in that time—innovate, get smarter, drive their costs down, and that’s what’s happening right now.”

Now, we could roll our eyes—after all, shale execs are notorious for saying things like “we’re cash flow positive now, really!” right before announcing layoffs and asset sales. But what if Wright’s not just blowing smoke?

History favors shale’s prospects of survival

The shale industry did survive the 2014–2016 oil price collapse. Admittedly, it was barely. And there were some individual players that couldn’t keep their heads above water. But overall, US shale emerged leaner, meaner, and with a few more gray hairs. Costs dropped. Frac stages multiplied like rabbits. Wells got longer, and so did the breakeven charts in investor decks. Could we see a similar cycle of innovation again, or has innovation reached its peak? The latter scenario would be hard to argue.

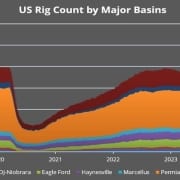

But it’s possible. As Wright admitted, “investment decisions are going to be tailored if prices stay this low for a long period of time.” Translation: the rig count will take a hit, and Wall Street won’t be lining up to throw money at growth. But shale’s not dead.

Click here to read the full article

Source: Oil & Gas 360

—

If you have any questions or thoughts about the topic, feel free to contact us here or leave a comment below.