DISCLAIMER: We are not financial advisors. The content on this website related to Offshore drilling is for educational purposes only. We merely cite our own opinions. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won’t experience any loss when investing. Always remember to make smart decisions and do your own research!

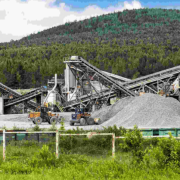

Offshore drilling is a critical part of the global energy landscape, contributing significantly to the extraction of oil and natural gas. As offshore reserves become an increasingly important source of energy, understanding how these activities affect royalty payments is essential for stakeholders, especially landowners, investors, and government entities. Royalty payments are a key financial component for those who own the rights to minerals beneath the sea, as well as for governments that lease offshore lands to energy companies.

In this article, we’ll explore how offshore drilling connects to royalty payments, delving into the mechanics of how we structure these payments, the economic factors that impact them, and the broader implications for both landowners and government revenue.

Whether you’re a landowner with offshore drilling rights, an investor interested in the energy sector, or simply curious about the economics of offshore oil and gas extraction, this article will provide a comprehensive overview of the subject.

Understanding Offshore Drilling and Its Process

Offshore drilling refers to the extraction of petroleum and natural gas resources beneath the seabed, using drilling rigs located in the ocean. These resources are typically located in underwater rock formations, which are often rich in hydrocarbons. Offshore drilling is usually carried out in regions far from land, often at significant depths below the surface of the ocean.

The process of offshore drilling involves several stages:

- Exploration: Energy companies first conduct seismic surveys to identify potential sites for drilling. These surveys provide valuable data about the geological structure of the seafloor and help companies locate oil and gas reserves.

- Drilling: Once a site is identified, drilling rigs are deployed to create wells that can access the underwater reservoirs. Drilling technology has advanced significantly in recent years, allowing companies to drill in deeper waters and more challenging environments.

- Production: After drilling through the seafloor and into the oil or gas reservoir, workers bring the hydrocarbons to the surface using a combination of pumps, pipelines, and processing equipment.

- Decommissioning: Once a well reaches the end of its productive life, the company decommissions it and removes the equipment.

Offshore drilling operations are typically conducted by large energy companies, and the extracted oil and gas are sold on global markets. However, these operations are not without their complexities, and one of the most important considerations for both energy companies and landowners is the issue of royalty payments.

The Role of Royalty Payments in Offshore Drilling

Landowners or government entities receive royalty payments as compensation when companies extract oil and gas resources from the land or sea they own. Typically, these payments represent a percentage of the revenue generated from the sale of the extracted resources. The purpose of royalty payments is to ensure that those who own mineral rights receive compensation for the value of the resources that others are removing from the land or sea.

In the case of offshore drilling, companies usually pay royalties to the government or to landowners if the offshore land is privately owned. Governments, particularly in countries with extensive offshore reserves, often rely heavily on royalty payments as a significant source of revenue. This is particularly true for countries with substantial oil and gas resources like the United States, Brazil, Norway, and Australia.

The amount of the royalty is determined by several factors, including:

- The price of oil or gas: Higher commodity prices typically lead to higher royalty payments because the payment is based on a percentage of the revenue generated from the sale of the extracted resources.

- Production levels: The more oil or gas that is extracted from the well, the higher the royalties. The volume of production can fluctuate depending on the well’s output, which is affected by factors such as reservoir size, drilling technology, and market conditions.

- Royalty rate: The specific percentage of revenue that is paid as royalty is often established in contracts or government regulations. In many cases, the royalty rate is fixed, although some agreements may include sliding scale mechanisms or adjustments based on production or market conditions.

The government and the drilling operator pay the royalties on a regular basis for offshore drilling projects, often quarterly or annually, depending on their agreement.

Key Factors Affecting Offshore Royalty Payments

Several factors can impact the amount of royalty payments landowners or governments receive from offshore drilling operations. Anyone involved in the industry or holding rights to offshore resources must understand these factors.

Price Volatility of Oil and Gas

One of the most significant factors affecting royalty payments is the price volatility of oil and natural gas. Geopolitical events, economic conditions, supply and demand dynamics, and other factors influence global markets and can cause significant fluctuations in the price of these commodities.

When oil and gas prices are high, the revenue generated from offshore drilling projects increases, leading to higher royalty payments for landowners or governments. Conversely, when prices fall, the revenue generated from production decreases, and royalty payments may be lower.

For instance, during periods of geopolitical instability in oil-producing regions or economic downturns, the price of oil can drop sharply, reducing the overall income from offshore drilling operations. Landowners and governments that rely on these payments as a major source of revenue are particularly vulnerable to these price swings.

Production Rates

The production rates of an offshore well also play a crucial role in determining royalty payments. High production rates often lead companies to extract larger volumes of oil or gas, which in turn results in higher royalty payments. However, offshore wells, especially in deepwater or ultra-deepwater environments, can experience declining production rates over time. As a result, early-phase royalties can be much higher than later-phase royalties.

Additionally, advancements in drilling technology, such as horizontal drilling or hydraulic fracturing, can increase the efficiency of offshore operations, allowing for longer-lasting wells and higher cumulative production. This can directly affect the royalty income that landowners or governments receive over the life of a well.

Lease Terms and Royalty Agreements

The specific terms of the lease agreement between the government and the energy company (or between landowners and operators) can also influence royalty payments. These terms outline how the company will pay a percentage of revenue as a royalty, along with any additional fees, deductions, or conditions.

The government sets the royalty rate in some cases, particularly in countries with significant offshore reserves. In other cases, the royalty rate may be negotiable between the landowner and the drilling company. Lease agreements may also contain provisions related to bonus payments, signing bonuses, or additional compensation for the landowner or government.

Moreover, some lease agreements feature escalating royalty rates based on increased production or the achievement of certain milestones. This allows landowners and governments to benefit more as production grows, offering an incentive for energy companies to maximize output.

Environmental and Regulatory Factors

Environmental concerns and regulatory changes can also impact offshore drilling operations and, by extension, royalty payments. Governments often impose stringent regulations to ensure that companies conduct offshore drilling in a manner that minimizes environmental harm. These regulations may include requirements for spill prevention, waste management, and habitat protection.

Compliance with these regulations can increase the operational costs of offshore drilling, potentially reducing the amount of revenue available to pay royalties. Additionally, environmental concerns may lead to temporary suspensions or cancellations of offshore drilling projects, which can impact the consistency of royalty payments.

Landowners or governments that rely on royalties as a steady income source should carefully consider these regulatory risks, as shifts in environmental policies could cause fluctuating or reduced royalty payments.

Offshore Drilling and Government Revenue

For many countries, offshore drilling is a significant contributor to national revenue. Governments lease offshore lands to energy companies, allowing them to explore, drill, and produce oil and gas in exchange for royalty payments. These payments typically represent a percentage of the revenue that the company generates from the sale of the extracted resources.

Governments often use the revenue generated from offshore drilling royalties to fund public services, infrastructure projects, and economic development initiatives. In some oil-rich nations, offshore royalties represent a major source of income, significantly impacting the national economy.

For example, in countries like Norway, the United States, and Canada, offshore oil and gas royalties make up a substantial portion of government revenue. In these countries, the management of offshore resources is a key policy consideration, with governments working to balance the economic benefits of drilling with environmental protection and the long-term sustainability of resources.

The Impact of Offshore Drilling on Landowners

For private landowners with rights to offshore mineral resources, the relationship between offshore drilling and royalty payments is highly significant. Many landowners lease their offshore rights to oil and gas companies in exchange for royalty payments, which can provide a steady income stream over the life of the lease.

Landowners typically receive a percentage of the revenue generated from the sale of the extracted oil or gas, based on their mineral rights in the leased area. The amount of royalty they receive will depend on factors such as the production rates, market prices, and the specific terms of the lease agreement.

Landowners should also be aware of the potential risks and rewards associated with offshore drilling. While high oil and gas prices can lead to substantial royalty payments, fluctuations in commodity prices, declining production rates, and regulatory challenges can impact the long-term financial benefits.

Offshore drilling is a complex and vital component of the global energy industry, with significant implications for royalty payments. For landowners and governments, understanding the factors that affect these payments — such as oil and gas prices, production rates, lease terms, and environmental regulations — is essential to navigating the offshore drilling landscape. By recognizing the interplay between offshore drilling operations and royalty income, stakeholders can better manage the financial risks and opportunities associated with this critical sector. Whether you’re a landowner, an energy company, or a policymaker, a thorough understanding of offshore drilling and royalty payments is key to making informed decisions and maximizing the value derived from offshore resources.

Do you have questions related to Offshore drilling? Feel free to contact us here.