Rising oil prices climbed more than 3% on Tuesday in the immediate aftermath of an Iranian missile attack on Israel. The spike in prices is expected to push up the price of U.S. gasoline, experts told ABC News.

Drivers could face a price increase of between 10 and 15 cents per gallon, experts estimated. The national average price of a gallon of gas currently stands at $3.20, AAA data showed.

A further escalation of the conflict between Israel and Iran could send oil and gas prices significantly higher, said Ramanan Krishnamoorti, a professor of petroleum engineering at the University of Houston.

“Clearly this will have a huge impact on gas prices,” Krishnamoorti told ABC News. “There’s no doubt about that.”

Iran said the attack on Tuesday was retaliation for a wave of assassinations carried out by Israel over the last several weeks targeting Hezbollah leaders. Israel will have a “significant response” to Iran’s attack, an Israeli official told ABC News.

While sanctions have constrained Iranian oil output in recent years, the nation asserts control over the passage of tankers through the Strait of Hormuz, a trading route that facilitates the transport of about 15% of global oil supply.

Important shipping route

Passage through the Suez Canal, another important shipping route for crude oil, could be impacted by further attacks. This is what happened with Yemen-based Houthi attacks on freight ships earlier in the war, Krishnamoorti said.

Despite a recent uptick, the price of oil stands well below a 2022 peak reached when the blazing-hot economic rebound from the pandemic collided with a supply shortage imposed by the Russia-Ukraine war. Gas prices, meanwhile, have plummeted in recent months.

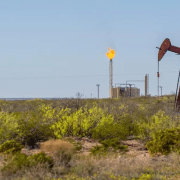

The U.S. set a record for crude oil production in 2023, averaging 12.9 million barrels per day, according to the U.S. Energy Information Administration, a federal agency.

Click here to read the full article

Source: ABC News

—

Do you have any questions or thoughts about the topic? Feel free to contact us here or leave a comment below.