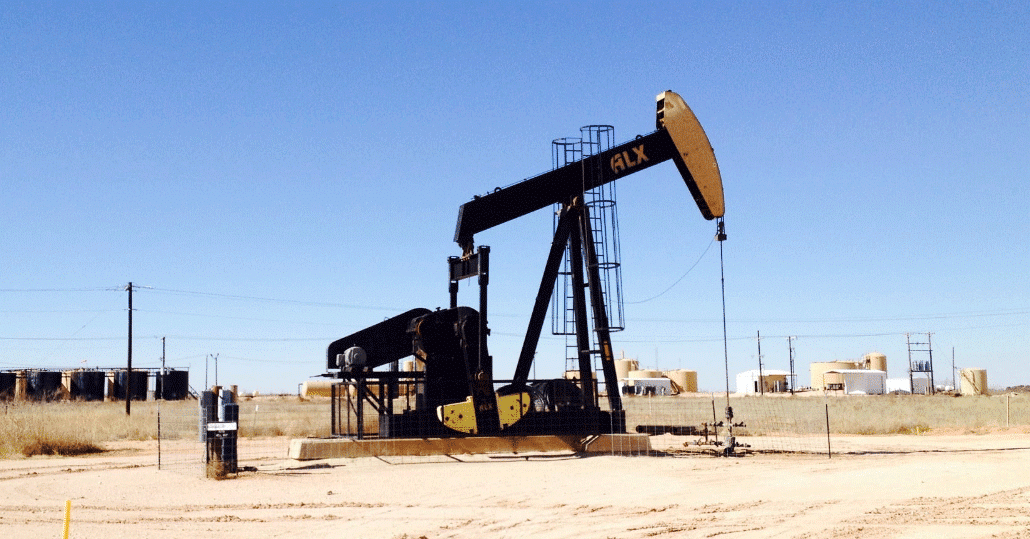

Oil production from the seven largest U.S. shale regions is set to decline by 46,000 barrels per day (bpd) in April, but output in the biggest and most prolific basin, the Permian, is expected to eke out a production gain next month, EIA data showed.

According to the EIA’s Drilling Productivity Report, shale production is set to drop by 46,000 bpd to 7.458 million bpd next month. All oil-producing regions except for the Permian are expected to see their production drop in April, but the Permian basin should see output rise by 11,000 bpd to 4.292 million bpd, EIA’s latest estimates show.

While the Permian is expected to increase its oil production, the Niobara and Eagle Ford regions are set for the biggest declines, by 15,000 bpd each, next month. Production in the Anadarko region is seen down 14,000 bpd from March to April, while production in the second most prolific region, the Bakken, is expected down by 12,000 bpd to 1.116 million bpd, the lowest level since July last year. Output in the Appalachia region is forecast slightly down by 1,000 bpd, and production in the Haynesville formation is set to remain flat.

Click here to read the full article.

Source: Oil Price