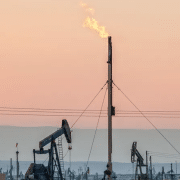

Oil price rises (CL=F, BZ=F) have moved higher following news that producer BP (BP) will temporarily halt shipments through the Red Sea. After reported attacks on vessels delivering on this route. Analysts estimate 12-15% of the global oil supply moves through this passage from the Middle East. Meaning any prolonged closure could impact availability in relevant markets.

Yahoo Finance Ines Ferré breaks down the details and what these pressures will mean for oil and natural gas prices (NG=F).

And what we’ve seen today is a bump for WTI for crude oil. Let’s take a look at the chart so you can see where we’re at. With WTI and crude both jumping more than 2% during today’s session. This is after British oil giant, BP, said that it was pausing ship shipments via the Red Sea. After Houthi rebels were attacking ships. This was a precautionary pause.

Several shipping companies have been pausing their shipments, including Evergreen, that’s a global container shipping company. Now, the Red Sea, that’s connected to the Mediterranean Sea by the Suez Canal. Anywhere between 12 and 15% of oil is move via the Suez Canal, so it is a very important area that’s connecting– that is a shipping route connecting Europe to Asia.

Click here to read the full article

Source: yahoo!finance

—

If you have any questions or thoughts about the topic Oil Price Rises, feel free to contact us here or leave a comment below.