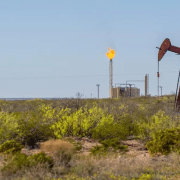

Increasing financial constraints, a low commodity price environment and a shrinking pool of prospective basins have transformed how Oil and Gas Explorers for new barrels. Across the globe operators are prioritizing low-risk, low-cost near field or infrastructure-led exploration (ILX) prospects instead of expensive, high-risk exploration plays. ILX, although not a recent phenomenon, is a reliable avenue that capitalizes on existing production hubs and pipeline networks to commercialize smaller discoveries that might otherwise remain untapped.

As price volatility, growing sustainability pressures and rigorous capital discipline take center stage, Rystad Energy predicts little growth of exploration budgets this year, standing at around $50 billion. According to the company’s analysis, Indonesia, the US and Norway will emerge as ILX hotspots this year.

The global oil and gas industry is now confined to a handful of highly prospective basins, with explorers increasingly prioritizing low-cost, near-field prospects that can deliver quick returns. Conventional exploration spending has declined significantly, from its peak of over $117 billion annually in 2013 to around $50 billion per year in recent years. Unlike greenfield projects that require significant capital for standalone infrastructure, ILX benefits from lower development costs, shorter lead times, and reduced emissions. The strategy has so far proven to be a success, with the last five years boasting nearly 900 ILX wildcat wells drilled, achieving a 42% exploration success rate over this period, significantly exceeding the global exploration success rate of 32%.

Click here to read the full article

Source: Oil Price

—

Do you have any questions or thoughts about the topic Oil and Gas Explorers? Feel free to contact us here or leave a comment below.