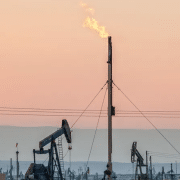

Oil and Gas Earnings:

Oil and Gas Earnings: Imperial Oil is set to kick off third-quarter oil and gas earnings on Friday.

A fresh read on how companies fared as benchmark crude prices climbed to a 10-month high above US$94 per barrel.

West Texas Intermediate (WTI) crude (CL=F) prices averaged US$82.10 for the three months ended Sept. 30.

That reporting period preceded increased volatility that has roiled commodity markets amid of a widening war in the Middle East

RBC Capital Markets analyst Greg Pardy is calling for Canadian oil and gas companies to showcase “much stronger financial performance amid robust upstream-downstream commodity price.”

He points to an 11% quarterly jump in WTI prices, as the loonie held steady against the U.S. dollar.

Oil Prices Caught Tailwinds

“Oil prices caught tailwinds in the third-quarter fueled by expectations of a soft-landing and Saudi Arabia’s extended unilateral one million barrel per day production cut through the remainder of the year,” Pardy wrote in a recent note to clients.

Among the oilsands-weighted majors – Canadian Natural Resources, Suncor Energy, Cenovus Energy, and Imperial – he estimates free cash flow jumped 127% in the third quarter, as the group shaved $3.1 billion from its collective net debt pile.

National Bank, Travis Wood highlights “significant strengthening in crude prices quarter-over-quarter,” as well as the absence of impacts on production.

“We are expecting cash flow per share to be up by 23% on a quarter-over-quarter basis,” he wrote.

The iShares S&P/TSX Capped Energy Index ETF – a basket of Canada’s largest oilsands stocks – has added more than nine per cent year-to-date.

Click here to read the full article

Source: yahoo!finance

—

If you have any questions about the topic, feel free to contact us here