⚠️ IMPORTANT LEGAL DISCLAIMER:

The information provided on this page is for general informational purposes only and does not constitute legal, financial, or investment advice. Oil and gas laws, mineral rights regulations, and royalty structures vary significantly by state and jurisdiction. While we strive to provide accurate and up-to-date information, we do not guarantee that, and laws may have changed since we published.

You should consult with a licensed attorney specializing in oil and gas law in your jurisdiction, a qualified financial advisor, or other appropriate professionals before making any decisions based on this material. Neither the author nor the publisher assumes any liability for actions taken in reliance upon the information contained herein.

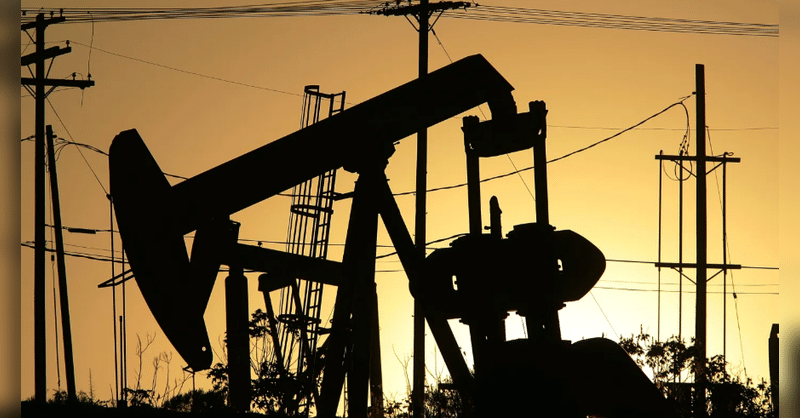

Mineral rights are often highly valuable assets, especially for owners of oil, gas, coal, metals, or other subsurface deposits. But what happens when someone who owns or leases mineral rights becomes insolvent or files for bankruptcy?

Bankruptcy protection introduces legal dynamics that affect how creditors can claim those rights, how they treat income or royalties, and what strategies rights-owners or lessees can use to preserve or maximize value.

This guide explains how bankruptcy protection in the U.S. interacts with mineral rights, identifies the protected (and vulnerable) rights, discusses landmark cases, outlines statutory rules, and provides practical strategies for rights-holders, lessees, creditors, and attorneys.

Nature of Mineral Rights and Why Their Treatment in Bankruptcy Matters

Mineral rights refer to rights in subsurface resources: the right to explore, extract, and profit from minerals beneath the land. You can own these rights separately from surface rights.

Rights may generate revenue via royalties, lease payments, production payments, or other contractual arrangements.

Because mineral rights can yield large cash flows, they tend to be key assets in a debtor’s estate. Bankruptcy attempts to balance the interests of the debtor (or insolvency claimant) and the creditors. How the law treats mineral rights in bankruptcy affects:

- Whether mineral rights are part of the bankruptcy estate

- The bankruptcy debtor may reject contracts or leases involving mineral rights.

- Whether royalty income or future payments are collectible or exempt

- Whether creditors can seize or force sale of such rights

Understanding these dynamics is especially important for landowners, mineral rights owners, producers, and lessees whose revenue depends on those subsurface resources.

The Automatic Stay and Initial Protection for Mineral Rights

Once a bankruptcy case is initiated, an automatic stay goes into effect. This is a powerful legal mechanism that immediately halts many creditor actions, including attempts to seize, foreclose, or enforce liens against the debtor’s property. The automatic stay shields mineral rights, which are property of the debtor in many cases, from many external pressures.

This stay protects rights, leases, and mineral income streams from interruption (to a degree). It provides breathing space while the bankruptcy process unfolds. However, the automatic stay does not guarantee that all obligations under leases remain unaffected, or that all future income is untouchable.

As we consider whether the bankruptcy estate includes mineral rights, whether certain contracts or leases can be rejected, and which exemptions under state law may apply, key issues emerge.

Defining What Belongs to the Bankruptcy Estate

One of the first questions in bankruptcy involving mineral rights is: Do those mineral rights, and associated contracts, become property of the bankruptcy estate? Under U.S. Bankruptcy Code, the “estate” includes all legal or equitable interests of the debtor in property at the time of the bankruptcy filing. If mineral rights are owned by the debtor (or the debtor holds leasehold or royalty interests), they often are part of the estate.

However, state law plays a crucial role in determining what constitutes an interest in property. For example, whether a lease of mineral rights is treated as a real property interest (in which case it is more likely part of the estate) or a simpler contractual right or personal property interest. The classification affects whether the debtor can reject the lease if it wishes, or whether creditors can assert claims over royalty income or future payments under the lease.

Unexpired Leases and Rejection of Obligations

Debtors in bankruptcy often examine their existing contracts and leases to determine whether certain ones are burdensome. Under the Bankruptcy Code, a debtor can reject unexpired leases or executory contracts, subject to court approval, if continuing them is disadvantageous. Whether a lease involving mineral rights is “unexpired” or “executory” depends on its terms and on state law classification of what kind of interest is involved.

In many situations, courts have held that mineral leases provide rights that resemble real property leases for oil and gas or royalty interests, making them less likely to be rejected. Indeed, some leases are considered too integral to the business operations and too valuable to discard. The courts balance the potential benefit to creditors of rejecting costly leases against the value those leases still provide.

Treatment of Royalty Income and Post-Petition Payments

Mineral rights often involve royalty streams — payments to the rights owner based on production or sale of minerals. These income streams raise special issues in bankruptcy:

- The mineral rights owner typically treats the money owed before the bankruptcy filing as a claim in bankruptcy, subject to creditor priorities.

- Post‐petition royalty income: Amounts accruing after the filing are more complicated. If income is tied to ongoing production or leases the debtor holds, those revenues may be part of the estate and used to satisfy obligations. Rights‐owners may petition for payments or protections depending on whether they own the rights or are lessees, and how their contracts are structured.

- Exemptions: Some state laws provide that certain portions of royalty income, or rights tied to property exempt under homestead or similar laws, are excluded from the bankruptcy estate.

State law again plays a large role: what royalty interests can be exempted, how income is characterized (property vs personal income), and whether payments due after a certain time (post petition) are subject to claims by the estate.

State Law Variations and Homestead Exemptions

Because bankruptcy is federal, but property law (including exemptions) is heavily state-based, the impact on mineral rights heavily depends on the state in which the rights are located, and the state of residence of the debtor.

Many states provide exemptions for homestead or other property, which may extend to mineral rights if those rights are tied to property defined as exempt. For example, in Texas, mineral rights associated with homestead property may be protected, though royalties from non-homestead properties likely are treated differently.

Where mineral rights are severed from the surface estate, or are not tied to a homestead, they may be more exposed in bankruptcy proceedings. Because state laws differ on what rights are exempt and how mineral or royalty income is treated, knowing local law is essential.

Creditor Claims, Liens, and Security Interests

Creditors often seek to secure their interests against valuable assets of the debtor. In the case of mineral rights, this could include:

- Securing liens on unextracted minerals or on production proceeds

- Converted: Treat lenders or investors to royalty interests or leasehold revenues as collateral or as part of assets that they may seize or sell.

The ability of a creditor to enforce a lien or security interest depends on how the rights are titled, how the debtor agreed to grant security, whether the rights are classified as real property or personal property under state law, and whether the debtor properly perfected the liens or security interests.

Bankruptcy courts review whether those liens are valid, whether the rights granted are truly ownership interests, and if contractual covenants or agreements grant security in advance. Sometimes courts have ruled that state law does not recognize certain covenants or agreements that purport to grant real property interest over minerals, which limits a creditor’s ability to seize assets notwithstanding the contract.

Notable Case Law and Precedents

Several cases illustrate how bankruptcy treats mineral rights and associated contracts. These precedents shape how drafters create contracts, what protections rights-holders may have, and how courts analyze conflicting claims.

- Courts have held that many mineral leases are real property leases, making them harder to reject or discard in bankruptcy.

- In a Texas case, non-homestead royalties were held to be part of the bankruptcy estate once paid, but royalties tied to homestead property had some protection.

- In Delaware, a landowner whose mineral rights were leased to a debtor tried to claim administrative expenses for post-petition surface damage and construction activities. The court denied the administrative claim under the circumstances.

- In various jurisdictions, agreements called farmout agreements (in which one party carries another and drills in exchange for future rights) are treated specially; under certain conditions, the farmor (party giving opportunity) cannot reject the contract to deprive the farmee of rights.

These precedents show that both contract structure and state law are critical, and courts often interpret ambiguous grants narrowly in favor of creditors or in line with established state property law.

Risk Exposure for Mineral Rights Owners or Lessees

Owners or lessees of mineral rights face several risks when bankruptcy enters the picture:

- A debtor lessee might reject or terminate leases or not maintain proper obligations under them if the court allows; rights holders may lose revenue.

- Creditors may claim portions of royalty income, especially if it is due or accrued before filing or if rights have been pledged as collateral.

- Contractual covenants or obligations might be found unenforceable under bankruptcy if not properly perfected or recognized under state law.

- Expenses, environmental obligations, or remediation requirements may become burdensome if the debtor cannot meet them.

- Delay in royalty payments or income streams due to court stay or disputes over ownership.

Rights-holders need to anticipate these risks, and contractually structure their agreements to provide protection where possible.

Protective Strategies for Rights-Holders and Lessees

Rights-holders and lessees can take several measures in advance or during bankruptcy proceedings to protect their interests:

- Ensure clear title and ownership documentation: Proper recording of mineral rights, leases, royalty interests, and any assignments or transfers helps establish standing in bankruptcy.

- Use contracts that recognize state law definitions: Leases, farmouts, royalty agreements should align with state law definitions of real property vs personal property, include protections against rejection, and clearly state whether interest is severable.

- Include security or collateral provisions: Where possible, include clauses that allow securing of royalty streams or lease revenues, or liens on production or proceeds, subject to perfection under state law.

- Negotiate consent and approval rights: Rights holders may insist on clauses requiring debtor compliance with environmental, maintenance, or operating obligations, so that a debtor cannot abandon important functions under lease.

- Structure royalty income or lease payments to maximize exemptions: If state law provides exemptions for certain property or income, structure ownership (e.g. via entities or homestead) to take advantage of those.

- Monitor debtor actions and file timely claims: Rights holders should monitor bankruptcy filings, assert claims for unpaid royalties or damages, and where applicable seek relief from automatic stay if debtor interferes with rights.

- Recognize that mineral development often carries post-closure or environmental responsibilities, and creditors may want to ensure that they secure or allocate those obligations.

- Plan for post-petition income flow: Agreements that ensure continuing lease obligations (like maintenance payments) or guarantee that royalty or production payments continue may help protect revenue streams.

Creditor Strategies and Priorities

Creditors facing estates that include mineral rights will also want to assess, protect, and potentially monetize those rights. Some strategies include:

- Ensure that you properly perfect any collateral or lien claims against mineral rights or income streams under state law.

- Valuation of mineral rights: Understand market value of the rights, projected royalty or production income, costs of extraction, and risks.

- The creditor might push for the assumption of valuable leases with the debtor rather than rejection, ensuring continued income.

- In some bankruptcy plans or liquidations, companies may sell or assign mineral rights to recover value for creditors.

- Recognize that mineral development often carries post-closure or environmental responsibilities, and creditors may want to ensure that those obligations are secured or allocated.

- Monitoring statute of limitations and filing deadlines: Bankruptcy law imposes deadlines for asserting claims; royalty holders, lessees, or creditors must be timely.

Case Studies Illustrating Treatment of Mineral Rights

Examining real cases helps illustrate how courts have resolved conflicts involving mineral rights in bankruptcy.

- In In re Mineral Resources International, Inc. a debtor whose estate included mineral assets had to address valuation and handling of those rights in the reorganization plan.

- In Delaware in In re Southland Royalty Co. LLC and related cases, courts considered whether certain covenants in mineral or midstream service agreements were real property interests running with the land. The conclusion in some cases was that control provisions or certain service agreements did not amount to real property under applicable state law. This limited some creditor claims.

- In Texas, homestead exemptions and mineral rights interact to show that royalty interests tied to exempt property may receive protection, but when non-exempt property relates to mineral rights or royalty income, the estate can include them.

These cases highlight that contract drafting, state law classification, and the specific facts (ownership, location, lease terms) matter greatly.

Regulatory and Statutory Frameworks Affecting Mineral Rights in Bankruptcy

Several statutory rules in the U.S. affect how mineral rights interact with bankruptcy protections:

- Bankruptcy Code provisions regarding property of the estate, assumption/rejection of leases, administrative claims, automatic stay, and priority of creditor claims.

- State laws defining what constitutes real or personal property, the perfection of liens, property exemptions (homestead, personal property, etc.), and environmental or surface obligations.

- Federal leasing laws and regulations (e.g. Mineral Leasing Act, federal reserved interests) may impose obligations that survive bankruptcy or shape what rights creditors can assign or sell.

- Local statutes governing royalties, surface damage, and access rights, which may impose duties on lessees even when the lessor is bankrupt.

Understanding how these frameworks interact is key for drafting robust rights agreements and for both rights holders and creditors planning for insolvency contingencies.

Challenges and Limitations in Getting Protection Through Bankruptcy

While there are protections, there are also limits and challenges:

- Courts may refuse to enforce or may limit rights based on whether individuals properly established and documented contractual or legal rights.

- Entities that have pledged or encumbered mineral rights may already be subject to claims that take priority over new claims.

- Revenue streams may be uncertain, fluctuating with production, commodity price, or operational factors, which affects valuation, collateral reliability, and enforcement.

- Leases may have clauses that allow cancellation or termination in certain circumstances, which a bankrupt debtor might invoke (if permitted) or try to reject.

- Environmental or regulatory liabilities may survive bankruptcy and might even impose obligations on rights holders or successors.

- Automatic stay can delay enforcement or delay payments, but cannot always prevent ultimate loss of rights if the debtor fails to preserve them or to perform required contractual obligations.

- State laws vary, and some states are more protective of rights holders than others; rights holders in less protective jurisdictions or without strong contracts are more vulnerable.

Best Practice Contract Terms to Help With Bankruptcy Risk Management

When drafting or negotiating mineral rights agreements, or when leasing mineral rights, incorporating certain terms can help reduce risk from bankruptcy exposure:

- Assignment and Transfer Provisions: Enforceable clauses that require lessees or operators to maintain lease obligations even if assignment occurs, or to seek court approval in case of bankruptcy.

- Security or Guarantee Provisions: Require upfront security or escrow or personal or corporate guarantees to ensure payments or obligations (royalties, lease maintenance, environmental obligations) will continue.

- The lender grants a lien or assignment over proceeds or royalty payments to secure obligations, which they may perfect under state law.

- The contract explicitly outlines what happens if the lessee declares bankruptcy—whether the lessor can reject the contract or maintain it, and what notice the lessor must give.

- Audit Rights, Reporting, and Oversight: Frequent reporting, auditing rights, and cost transparency help non-operators or lessors verify compliance and performance.

- Selecting favorable state law and venue for disputes can influence how courts treat mineral rights in insolvency.

- Insurance and Environmental Liability Protections: Clauses ensuring that environmental and surface obligations survive bankruptcy, including indemnity, remediation, and insurance coverage.

- Exemption-Friendly Structuring: If relevant in your state, structure ownership in ways that maximize property or income exemptions — for example by tying rights to exempt property or through ownership by exempt entities.

Practical Advice for Rights-Holders Facing a Counterparty Bankruptcy

If you are a lessor or royalty owner dealing with a debtor (lessee or operator) in bankruptcy, you may take proactive steps:

- Monitor court filings to assess how the bankruptcy estate classifies the mineral rights or lease.

- File proofs of claim for unpaid royalties, unpaid lease payments, or damages for breach or rejection of leases.

- Seek relief from stay if debtor actions threaten to harm your property rights or income stream.

- Negotiate for assumption of lease rather than rejection where possible, offering to ensure performance if needed.

- Work with legal counsel to understand whether your state exemptions or property law will protect your interest.

- Be alert to deadlines (bar date), notice periods, and required proofs; failure to act in timely fashion may forfeit claims.

- Preserve documentation: lease agreements, payments, title, assignment or conveyance documentation.

- Consider purchasing creditor or lessee insurance or bonding where possible to reduce risk.

Future Trends and Evolving Issues

The landscape around mineral rights in bankruptcy continues evolving. Some of the emerging issues include:

- Increasing volatility in commodity markets which can stress leases and royalty income, increasing frequency of bankruptcies in producers or operators, making exposure more relevant.

- Regulatory changes or environmental policy that may add cleanup or remediation obligations, which courts may hold as enforceable even if debtor changes hands or is under bankruptcy protection.

- Increased scrutiny of abandoned or under-utilized leases, or environmental liabilities related to old operations, particularly in regions with tighter environmental enforcement.

- Digitalization and better data on production, ownership, payments which may make rights more transparent, assist verification, and assist in claim filing.

- Innovations in contract law or royalty financing which may offer ways to securitize royalty income, granting more protection or liquidity even in insolvency events.

- State legislatures are possibly reforming property law and exemptions to better address how mineral rights entities handle these assets when they become insolvent.

Mineral rights are valuable assets that can generate substantial income. However, they carry risk especially when related parties become insolvent or bankrupt. Bankruptcy protection provides some legal safeguards, such as the automatic stay and property of the estate. Many variables protect those rights or the income they generate.

The drafting of contracts, the proper recording of leases by lessees, the definition of property interests by state law, and the types of bankruptcy filers who submit heavily determine how mineral rights are treated in bankruptcy.

Income or royalties tie to exempt property. For rights-holders, lessees, and creditors alike, anticipating these issues, using protective contract terms, and acting proactively in bankruptcy proceedings are key to preserving or recovering value.