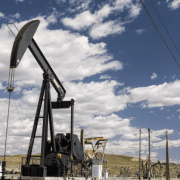

India seeks to import more US oil and gas and to step up purchases of crude oil and natural gas from the U.S. as it diversifies its energy supplies and confronts criticism by U.S. President Donald Trump over its imports of discounted Russian oil.

Trump said Wednesday that Indian Prime Minister Narendra Modi had personally assured him his country would stop buying Russian oil, in a move that might add to pressure on Moscow to negotiate an end to the war in Ukraine.

“There will be no oil. He’s not buying oil,” Trump said. The change won’t take immediately, he said, but “within a short period of time.”

Click here to read the full article

Source: AP News

—

Do you have any questions or thoughts about the topic related to how to import more US oil and gas? Feel free to contact us here or leave a comment below.