Fossil fuels could soon become significantly cheaper and more abundant as governments accelerate the transition to clean energy towards the end of the decade, according to the International Energy Agency.

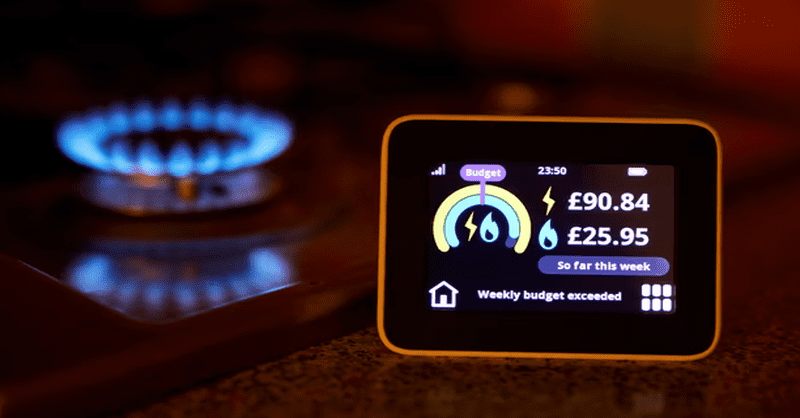

The world’s energy watchdog has signalled a new energy era in which countries have access to more oil, gas and coal than needed to fuel their economic growth, leading to lower prices for households and businesses.

The Paris-based agency’s influential annual outlook report found that energy consumers could expect some “breathing space” from recent spikes in global oil and gas prices triggered by geopolitical upheavals because investment in new fossil fuel projects has outpaced the world’s demand.

Fatih Birol, the executive director of the IEA, said the report confirms its prediction that the world’s fossil fuel consumption will peak before 2030 and fall into permanent decline as climate policies take effect. But continuing investment in fossil fuel projects will spell falling market prices for oil and gas, the IEA added.

“I can’t say whether or not we will see [oil prices of] $100 a barrel again, but what I can say is that despite the ongoing conflict in the Middle East we are still seeing oil prices in the $70s,” he said.

Oil prices dipped below $74 on Tuesday amid growing concern about weak Chinese demand.

Click here to read the full article

Source: The Guardian

—

If you have any questions or thoughts about the topic of Fossil fuels, feel free to contact us here or leave a comment below.