Chevron Corporation has set an ambitious goal to achieve production of 1 million barrels of oil equivalent per day (boe/d) from the Permian Basin by the year 2025. The company’s strategic focus is primarily directed towards the Delaware Basin segment of the Permian, located in New Mexico. This region has been identified as particularly advantageous due to its geological characteristics, which include high-quality source rock that is both thick and deep.

According to Duncan Healey, the asset manager for Chevron’s New Mexico operations, the geological attributes of the Delaware Basin allow for greater efficiency in extracting hydrocarbons. The high pressure present in the subsurface formations facilitates the extraction of oil and gas, making this area a more productive option compared to other regions within the Permian Basin.

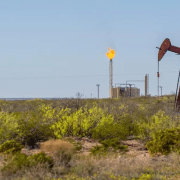

In addition to its production goals, Chevron is actively seeking to minimize its environmental impact by implementing innovative technologies and practices. The company has prioritized the use of electrical compressors for its operations wherever feasible, as opposed to relying on traditional natural gas-fueled compressors. This transition not only enhances operational efficiency but also contributes to a reduction in carbon emissions associated with production activities.

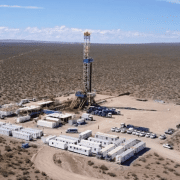

Hydraulic fracturing operations of Chevron

Furthermore, Chevron has reported a notable decrease in the carbon intensity of its hydraulic fracturing operations in the region, a development that underscores the company’s commitment to implementing sustainable practices within its extraction processes. This reduction in carbon intensity is a significant achievement, reflecting Chevron’s ongoing investment in innovative technologies and methodologies that enhance operational efficiency while minimizing environmental impact. By adopting advanced techniques and optimizing resource management, Chevron is not only improving its operational performance but also demonstrating a proactive approach to addressing the pressing environmental challenges of our time. These efforts are indicative of the company’s broader strategy to integrate sustainability into its core operations, ensuring that environmental considerations are at the forefront of its business decisions.

Through these initiatives, Chevron aims to strike a balance between its production objectives and its responsibilities as a steward of the environment. The company recognizes the importance of addressing the growing concerns related to climate change and resource sustainability, especially in an era where public and regulatory scrutiny is intensifying. By reinforcing its position as a leader in the energy industry, Chevron is taking meaningful steps towards reducing its carbon footprint and promoting a more sustainable energy landscape. This commitment not only enhances the company’s reputation but also aligns with the global shift towards cleaner energy solutions. As Chevron continues to innovate and embrace sustainable practices, it sets a benchmark for others in the industry, illustrating that it is possible to achieve economic growth while prioritizing the health of our planet for future generations.

Click here to read the full article

Source: Oil & Gas Journal

—

If you have any questions or thoughts about the topic related to Chevron updates, feel free to contact us here or leave a comment below.