With Hurricane Milton making landfall in the early hours of Thursday 10th October (EST). These are the two most significant hurricanes to make landfall so far. Francine and Helene have already impacted oil and gas operations in the Gulf of Mexico. Now, the inland United States. So what are the impacts of Atlantic Hurricane Season?

As analysts were gauging the many ways in which these hurricanes will affect oil and gas. Three different aspects of this can be considered. Tracking storm paths, shut-ins in production, and assessment of recovery timelines.

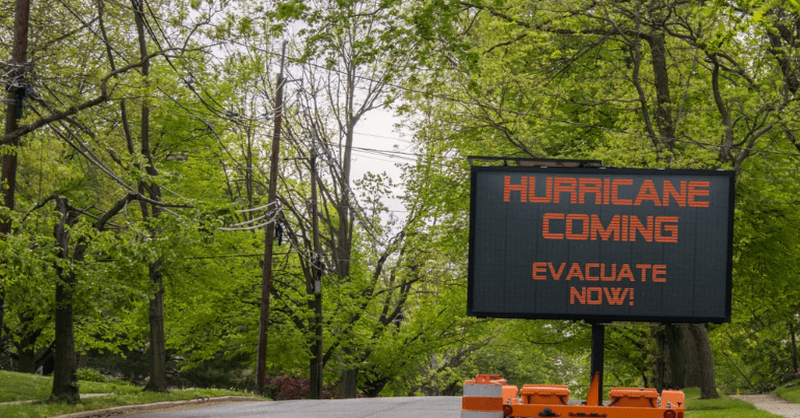

As of Tuesday evening (8th October), Hurricane Milton has strengthened once again. With that, agencies across the US, including a direct message from the White House itself, have said the hurricane could be the worst to hit Florida. President Biden addressed the issue by stating “evacuations are a matter of life and death”. It is in a stark warning to the residents of Florida. There are also official reports suggesting it has the potential to be the worst hurricane in a century to hit the US. The state agencies also say, “some areas”, of the storm surges will be “not survivable”.

The Closures

Further closures have been made to oil and gas facilities including Kinder Morgan’s Central Florida Pipeline systems. This carry gasoline and diesel between Orlando and Tampa. In addition to this, due to Tampa’s coastal position, Kinder Morgan have closed all bulk-fuel delivery terminals. Refiner Citgo has also followed suit and shut down its Tampa terminal, along with Buckeye, who have suspended Orlando based operations.

As of now there is not much that can be said until landfall takes place, and impact assessments can be made. For now, wind speeds will reach 160 mph at their peak, and storm surges are expected to be around 12-15 feet. With business insider already reporting US natural gas futures have fallen by 8% in recent days, this serves as an indicator of how serious hurricanes have become, not just bringing natural catastrophe and humanitarian disaster, but also increased economic shock felt domestically, and globally.

Click here to read the full article

Source: Energy Monitor

—

Do you have any questions or thoughts about the topic related to Atlantic Hurricane season impact? Feel free to contact us here or leave a comment below.